Taxes

Pelcro makes it easy to collect and remit all the required taxes. Learn more about all the different steps required to set it up and how we make it easy for you to calculate, manage, and report on taxes.

Page type: How-to guide

Overview

Configure tax collection on your Pelcro account so that taxes are automatically calculated, applied to invoices, and available in exportable reports. By the end of this guide, you will have:

- Defined your tax rules and nexus address

- Enabled automatic tax calculation

- Access to monthly tax reports and exports

Prerequisites:

- An active Pelcro account with admin access

- A list of tax rules that apply to your business (countries, rates, and regions)

- Your business's nexus address

Configuration

Set up a tax configuration on your Pelcro account based on the tax rules imposed on your business. Follow these steps to get started:

- Document all tax rules that apply to your business.

- Provide the documented rules to your account manager, or send them to [email protected].

- Complete the configuration checklist below.

Configuration Checklist

- Will plan prices displayed to customers be tax inclusive or tax exclusive?

- What is the primary Tax nexus address to be used?

- Which countries/states/provinces will taxes be collected in?

- Which products will taxes be collected on?

Please note that if you are planning to configure taxes to be enabled on your site, all of your offered products will require a customer address to ensure taxes are properly handled and processed.

Tax inclusion vs exclusion

The tax module supports both tax-inclusive and tax-exclusive pricing. This is configured based on your business's preference. With tax-inclusive pricing, the displayed price already contains tax. With tax-exclusive pricing, tax is added at checkout.

Reference: Supported Countries

For more information on countries which are supported within our tax collection module, please refer to this list.

Additionally, we support taxes for the following countries:

- United Arab Emirates

Reference: Tax Rules

Tax rules are configured and stored on the Pelcro platform to fulfill your tax needs. Provide all tax rules based on the user's shipping address.

Tax rules apply to the entire Pelcro account and cannot be customized per product or plan.

Here's what's usually needed to implement tax rules:

- List of countries where you would like to enable tax collection.

- For each country, list of individual tax rates at which you would like to enable tax collection

- For each tax rate, list of regions/provinces/states for which you would like to enable tax collection

For example, suppose you want to enable tax collection in Canada, which has three distinct tax rates: GST, PST, and QST. You want to collect different combinations of these taxes depending on the province.

Here is an example of what you would send to Pelcro:

| Province | Tax Rates Collected |

|---|---|

| Saskatchewan | GST only |

| Ontario | GST + PST |

| Quebec | GST + QST |

Tax Calculation

Pelcro automatically calculates the tax per subscription based on your business tax rules and the customer's shipping address. The calculated tax is also applied to all associated invoices.

To enable automatic tax calculation:

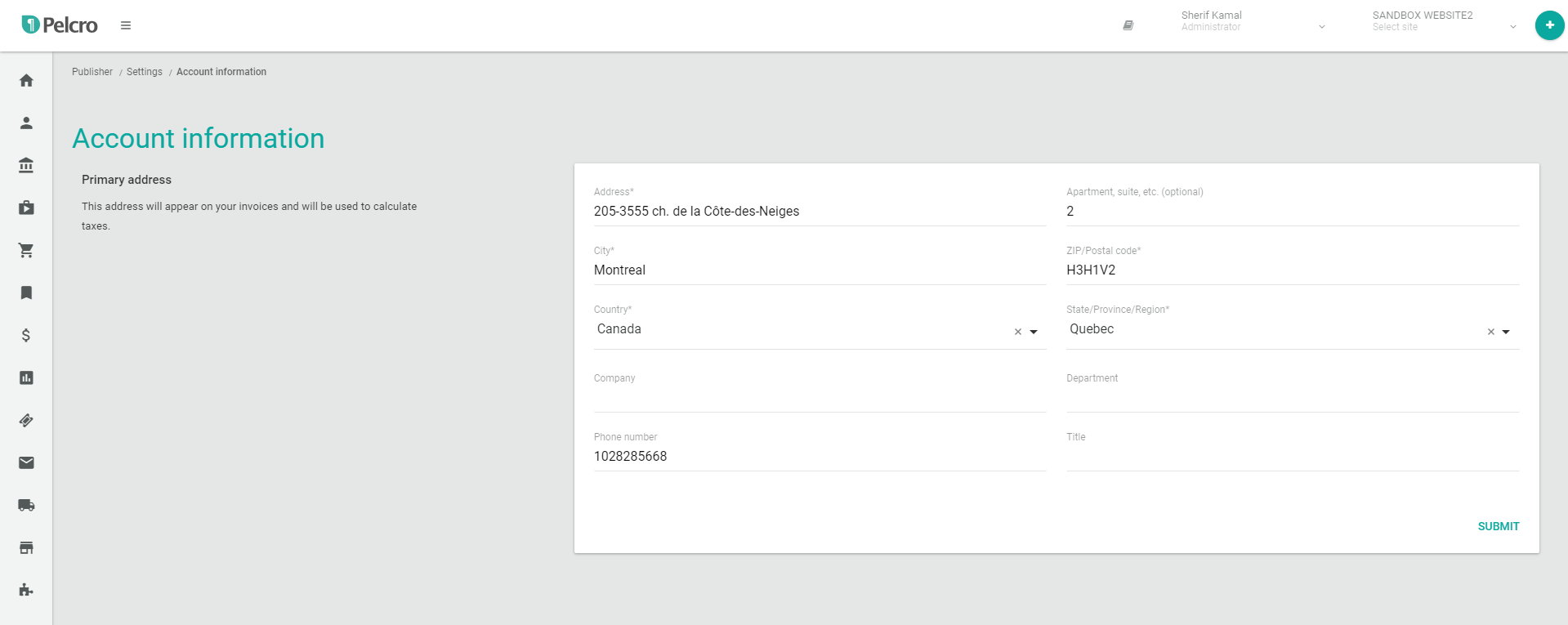

- Enter your nexus address under Settings > Account Information:

-

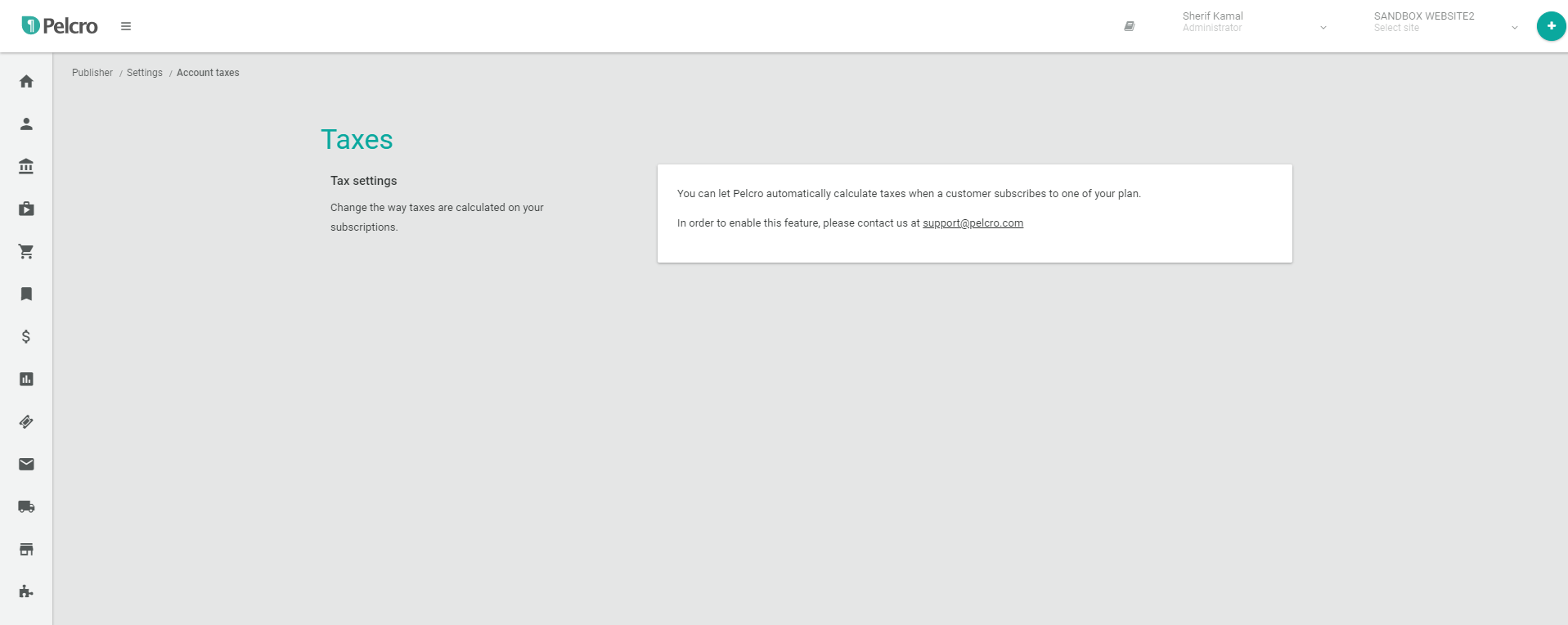

Contact Pelcro support to enable tax settings for your account.

-

Enable automatic tax calculation under Settings > Taxes:

Pelcro monitors and updates tax rate changes for supported countries and regions. If you notice a tax rate change that hasn't taken effect, contact [email protected].

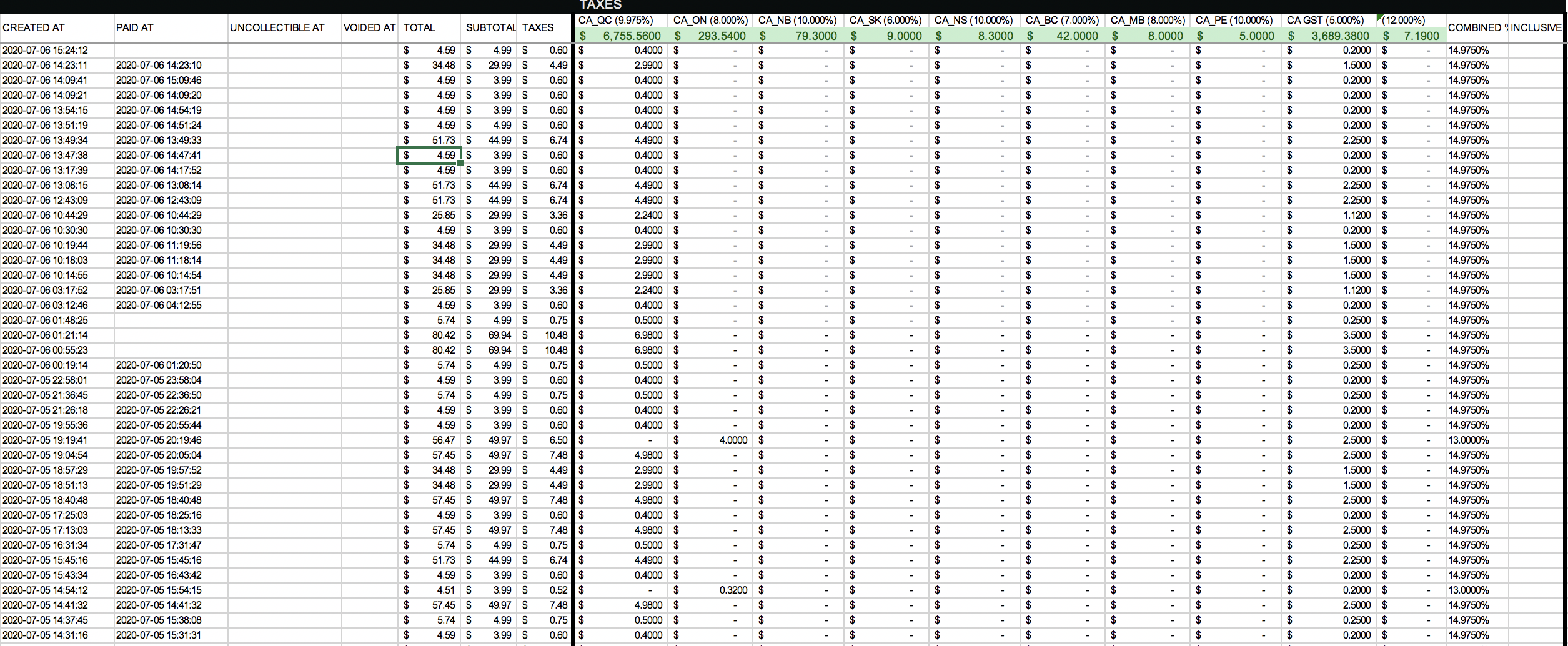

Reports and exports

All tax calculations are stored in our tax module and are available in exports for reference. The export of the taxes is segmented by month and currency and contains all references to the invoice, customer, and the calculated taxes. A summary of the taxes per month is also available in the export.

Explanation: Sales Tax Nexus

Sales tax nexus (a tax obligation triggered by your business's connection to a state) determines where you must collect sales tax.

What creates sales tax nexus?

All states define nexus slightly differently, but most consider a "physical presence" or "economic connection" as creating nexus. Physical presence includes:

- Having an office, employee, or warehouse

- Having an affiliate or storing inventory

- Economic nexus — making a certain dollar amount of sales or number of transactions in a state

- Temporarily doing business in a state (e.g., at a trade show)

What happens if I have sales tax nexus?

If you have nexus in a state, you must collect sales tax from buyers in that state. Determine the combined state and local sales tax rate. For example, Beverly Hills (90210) has a 9% rate: 6.5% California state + 1% Los Angeles County + 1.5% district rate.

Understanding location-based taxes

There are two models for calculating sales tax:

| Model | How it works |

|---|---|

| Origin-based | Charge the sales tax rate at your business location to all in-state buyers. |

| Destination-based | Charge the sales tax rate at the buyer's location, meaning you may charge multiple rates within a state. |

Some states apply different rules depending on whether you have home state nexus or are a "remote seller."

Troubleshooting

Tax is not being calculated on subscriptions

Verify that:

- Your nexus address is entered under Settings > Account Information.

- Automatic tax calculation is enabled under Settings > Taxes (contact [email protected] to enable this).

- The customer has a valid shipping address on file.

- Tax rules have been configured for the customer's country, state, or province.

Incorrect tax rate is being applied

Check the following:

- Confirm the customer's shipping address is correct — tax is calculated based on their location.

- Verify the tax rules you submitted to Pelcro match your current requirements.

- If a tax rate recently changed in your region, contact [email protected] to confirm the updated rate is applied.

Tax settings are not visible in my account

Tax settings must be enabled by Pelcro support before they appear in your dashboard. Contact [email protected] to request activation.

Next steps

- Supported countries list — View all countries and regions supported for tax collection.

- Contact support — Reach out to configure tax rules or resolve tax-related issues.

Updated 14 days ago